Table of Content

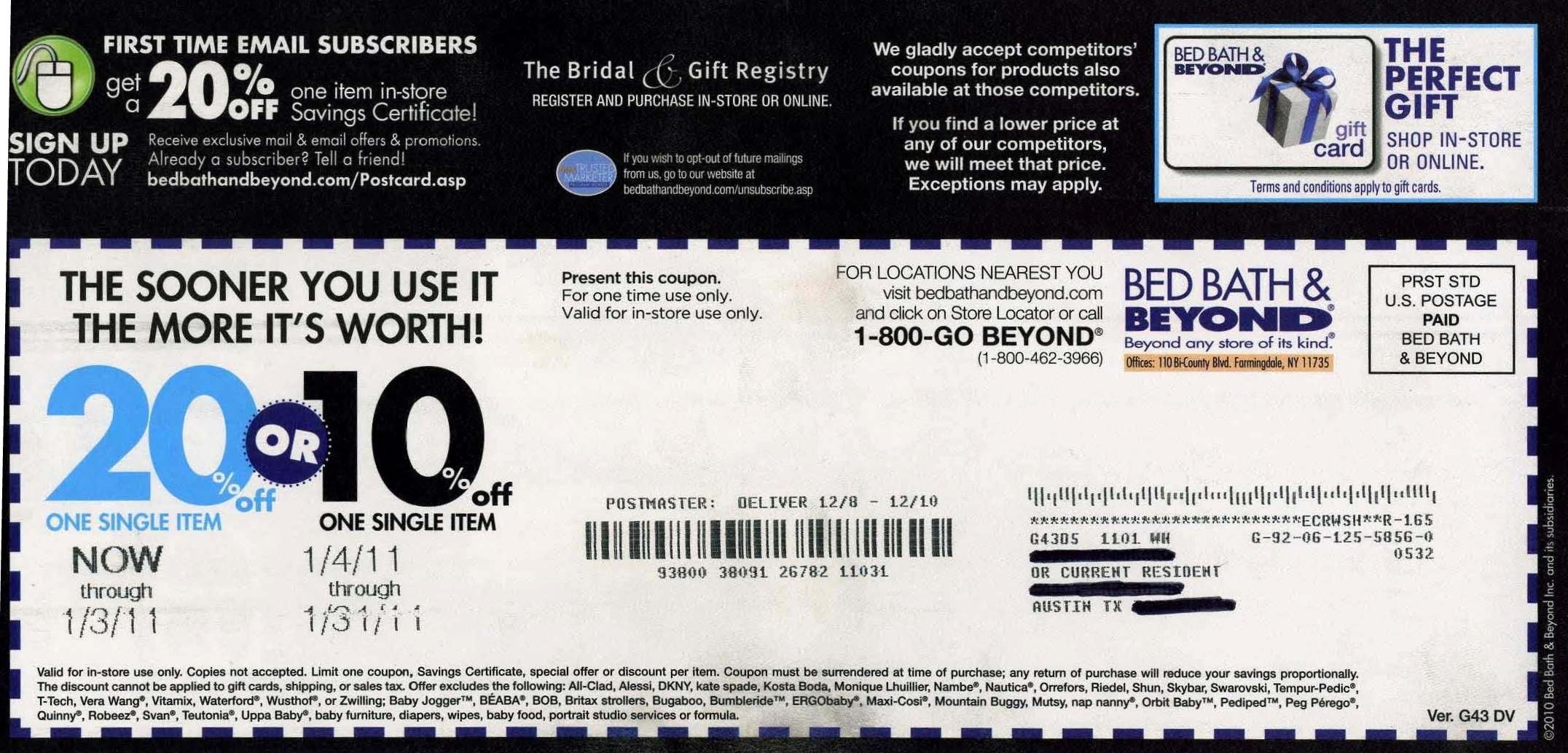

Gross profit margins declined by round 600 basis points year-over-year with web losses during the period of $366.2 million, up from a lack of $73 million in the year-ago comp. Bed Bath & Beyond's financials proceed to deteriorate as its Apes proceed to guess that the corporate's ongoing turnaround plan shall be successful. Bed Bath & Beyond hires Kirkland & Ellis, a regulation agency specializing in restructuring, to help the retailer with its debt, in accordance with a Bloomberg report citing an anonymous supply. That restructuring could include new loans and/or refinancing current loans.

The plan is to reduce back SG&A expenses by around $250 million by the end of fiscal 2022 and there are indicators that the efforts are already bearing fruit. SG&A bills through the second quarter of $634.9 million was a marginal improvement from $655 million in the year-ago interval. Bears can be right to state that SG&A still increased sequentially and that the decline is immaterial against the extent of the income decline. This in fact continues to place stress on the corporate's steadiness sheet. Comparable store sales crashed 26% from a yr in the past in the fiscal second quarter as the economic slowdown and poor stock quality weighed on store visitors. The challenged top line and elevated discounting led to the company posting an working lack of $168 million in the quarter.

In Regards To The Motley Fool

Such restricted urge for food likely reflects the concern amongst debt-holders on Bed Bath & Beyond's survivability and getting paid again if the corporate ought to go bust. The kitchen has become the center of the home where meals are created and where family and friends gather to share life’s special moments. Bed Bath and beyond has all of the necessities for a well-stocked kitchen whether you might be an accomplished residence cook dinner, a weekend warrior, freestyle artistic, or obsessive recipe wonk.

The retailer has battled all year long with tanking sales, weak retailer site visitors, low cash levels, and merchandise not aligned with customer tastes. Earlier this 12 months, the board ousted Bed Bath & Beyond's turnaround CEO Mark Tritton. Other execs have fled as cash-saving, cost-cutting efforts are underway. Bed Bath & Beyond announces a bond change offer because it looks to pay a few of its money owed. The supply includes buying again three groups of senior unsecured notes, together with one due in 2024, and providing new notes, due in 2027, with varying phrases and rates of interest.

Get Retail Dive In Your Inbox

Manufacturers and retailers of key merchandise for bedrooms and bathrooms. The retailer’s operating loss grows to $346.2 million from $84.1 million final 12 months, whereas web loss reaches $366.2 million from $73.2 million in the year-ago interval. Struggling retailer Bed Bath & Beyond is coming up woefully quick in a key debt exchange designed to offer the corporate some much-needed monetary respiration room. The company stated Tuesday that it might extend its debt exchange offer to Dec. 19 from Dec. 5. Management hasn't neglected the digital alternative, which now represents almost 40% of Bed Bath & Beyond's sales.

JPMorgan Chase conducted a marketing process for the corporate as it sought out about $375 million. A little over 5 months after taking a stake within the company, Ryan Cohen declares he will promote his shares in Bed Bath & Beyond. RC Ventures says it plans to promote all of its 9.5 million shares, representing about 11.8% of Bed Bath & Beyond’s outstanding shares. At the same time, Bed Bath & Beyond stories that net sales within the first quarter fell by 25%, whereas comps declined 23%. Building on a partnership that began in 2021, Kroger and the house items retailer launch an online offering that permits prospects to buy Bed Bath & Beyond and BuyBuy Baby items on the grocer’s website. The distressed house retailer skilled a C-suite shakeout, technique pivot and a board refresh because it continues to work on turning the enterprise around.

Blaming out-of-stocks at its Bed Bath & Beyond banner, the retailer suffers from $175 million in misplaced sales through the fourth quarter. Net sales fall 22% 12 months over 12 months to $2.1 billion, while comps decline by 12%. The retailer swings to a loss through the period, reporting a net loss of $159 million from a revenue of $9 million a year prior. Since that very first white sale in Philadelphia’s John Wanamaker and Co. department retailer in 1878, January has all the time been a great month to buy mattress linens. Those looking for hand-crafted customized bedding and draperies can discover a Gunzenhausen, Bavaria, Germany company that makes and sells high quality bed products. Many mattress and bath retail outlets sell a smaller choice of exclusive manufacturers.

Interest expense which has been comparatively low compared to long-term debt is now on the rise. This will continue to ramp up as the company's current quarterly operational money burn fee exceeds its money available to drive Bed Bath & Beyond to rely upon more debt to bridge its liquidity gap. Large-scale layoffs also have a near-term impression of increasing bills as severance funds get aggregated and paid out within a short while body.

An Inexpensive Stock Is Not Always An Excellent Deal

The retailer introduces a brand new loyalty program called Welcome Rewards, offering savings and benefits to prospects across all of its banners. To build out its omnichannel strategy, the retailer appoints Mark Danzig as its senior vice president of artistic and former Ikea exec Umesh Sripad as senior vp of digital. "For the fiscal third quarter, we are lowering our comparable gross sales estimate to [-23%] from [-15%] prior," Matuszewski warned. Get inventory recommendations, portfolio guidance, and extra from The Motley Fool's premium services. I have no enterprise relationship with any firm whose stock is mentioned on this article. Bed Bath & Beyond faces broader macroeconomic headwinds from rising mortgage charges as the Fed continues to hike rates of interest to fight high inflation.

These businesses help you discover the right designer textiles, luxurious linens, fixtures and accessories to create your dream house. Economic moat -- the ability to guard its market share in opposition to rivals. I/we haven't any stock, choice or similar spinoff place in any of the businesses talked about, and no plans to provoke any such positions within the subsequent seventy two hours. $1.44 billion a decline of 27.6% over its year-ago quarter and a small miss of $10 million on consensus estimates. On the same day, Bed Bath & Beyond’s Chief Customer and Technology Officer, Rafeh Masood, announces he'll resign from the company, effective Dec. 2.

Furthermore, the company — which has been heavily discounting merchandise this holiday season in an effort to raise badly wanted money — has shown subsequent to no signs of life underneath new CEO Sue Gove. Bed Bath & Beyond Inc. is an American chain of home merchandise retail stores. The chain operates many shops within the United States, Canada, Mexico, and Puerto Rico.

That mentioned, virtually anyone can open an e-commerce retailer nowadays, and apart from its fading model, there's little to make Bed Bath & Beyond stand out in this highly aggressive house. The company saw its digital gross sales drop 22% within the third quarter, and future weak point appears likely due to its weak moat. Rising mortgage rates will continue to pose headwinds to US housing in 2023 which can gradual the general demand for Bed Bath & Beyond's home merchandise product portfolio.

No comments:

Post a Comment